In short: short speculative positions; stop-loss at $657; initial target at $527.

California has postponed its effort to regulate digital currencies, we read on CoinDesk:

The state assemblyman [Matt Dababneh] behind efforts to regulate digital currency businesses in California cited the $65m hack of Bitfinex this week as evidence of the need for tighter industry controls.

In a statement issued following his state's decision to temporarily shelve further regulatory deliberations this year, he said that more time was needed to strike a balance between giving virtual currency businesses a firm foundation and ensuring consumers are protected.

(…)

Dababneh first proposed the bill last year shortly after becoming chairman of the state’s Banking and Finance Committee, and a revised version was once again introduced this year amid resistance from industry advocates.

In remarks, Dababneh credited conversations with "virtual currency experts, consumer organizations" as a deciding factor in the determination to suspend the proposed legislation until January of next year.

The general trend to regulate digital currencies will most likely continue. This is yet another case where Bitcoin regulation is actively discussed by the politicians. The fact that the bill was shelved citing concerns about the quality of the regulation is possibly a positive sign as the politicians might be inclined to give Bitcoin serious thought and not rush into with a half-baked proposition.

On the other hand, Bitcoin regulations are now years in the making and this will not speed up the process. On the whole, we are inclined to wait longer for a sound way to go forward rather than expect a faulty law earlier. The state of New York was first to regulate Bitcoin with a kind of a license. We expect California to follow suit in the next two years, perhaps with a regulation balancing the burden on Bitcoin firms and the protection offered to customers.

For now, let’s focus on the charts.

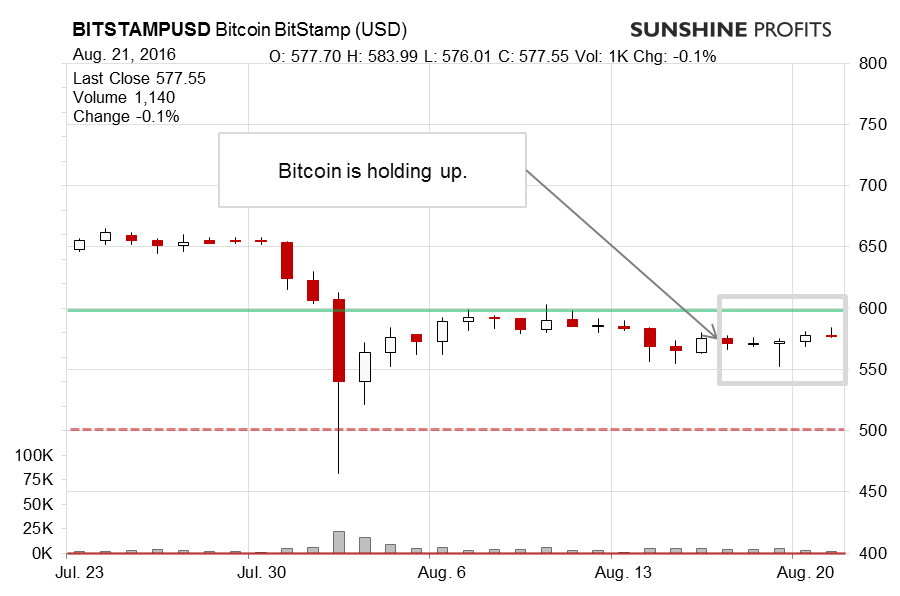

On BitStamp, we saw a weak move to the upside in the last couple of days. Does this change anything as far as the short-term outlook is concerned? Recall our previous comments:

Possibly the most important development is the breakdown below the 61.8% retracement level based on the June top and the recent bottom. This breakdown now looks verified and Bitcoin didn’t show enough strength on Tuesday to bring the currency back above this level. As such, the situation now looks like we have a failed test of this level behind us (the move from the early August low). Another potentially important feature here is that we don’t really have any important resistance levels until the currency reaches $500.

Bitcoin went up a bit but the resistance level based on the Fibonacci retracement remains in place. We haven’t really seen a move above this level and, as such, the situation is largely unchanged.

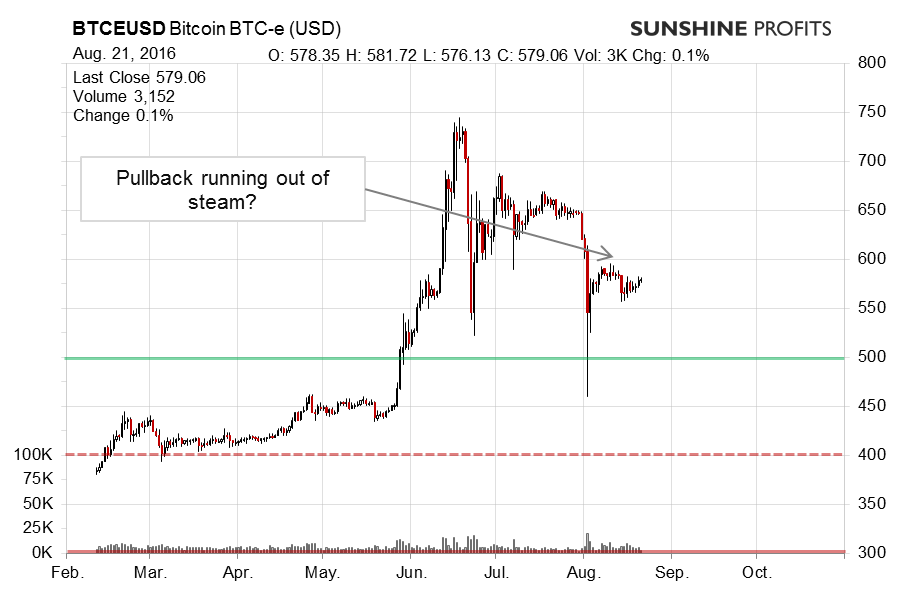

On the long-term BTC-e chart, we see a slight change from our previous alert. Recall what we wrote then:

The situation is still very much unchanged. Bitcoin is above the 38.2% retracement level based on the May-June rally but below the 61.8% level based on the decline from the June top to the recent low. This is mixed territory, however, the recent failed move up along with the lack of confirmed breakout above the latter retracement makes the situation more bearish than bullish. Again, if the decline accelerates from now (the odds are it will, in our opinion), there’s not much to stop Bitcoin from falling to around $500.

The change here is that Bitcoin is now back above the 61.8% level. This is a mildly bullish indication. We might see more action to the upside but this might still be too little to tilt the situation into neutral territory. The situation remains bearish at the moment of writing these words (around 12:30 p.m. ET).

Summing up, in our opinion short speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): short positions; stop-loss at $657; initial target at $527.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.