Bitcoin [BTC] has jumped to a fresh record high of $3545 this Friday following Thursday’s bullish inside day candle. BTC’s rival Bitcoin Cash [BCC] has tanked as some investors who got access to exchanges have dumped their coins. The sell-off in the newly created clone is a sort of victory for the original crypto currency.

Heightened curiosity feeds into the rally

BTC has been on a tear of late… and that has increased curiosity among investors about the virtual currency, which is being labelled as a 21st century gold. Investment banks like Goldman Sachs are taking more interest in the Bitcoin of late. More and more investors are becoming familiar with the digital currency.

However, it is all hype. Comparisons with gold are premature. What made gold a global safe haven asset? - Perception… that gold never loses its value. The perception has been created due to persistent demand over the last few hundred years from the two Asian giants - India and China/South East Asia… If Bitcoin has to rival gold, it has to gain widespread acceptance in India/China and young nations. It’s a long way to go.

For now, it is the curiosity and the hype that is feeding into the market and pushing the prices to record highs.

Bitcoin's behaviour is normal, premature to call it a bubble

Sceptics say the Cryptocurrency bubble could the worst in the modern history. They say the current rally in Bitcoin has all the elements of a bubble that has yet to turn into a mania before it bursts… I beg to differ.

The high volatility, big spikes and sudden price crashes are normal in a nascent market. One cannot expect a toddler to behave like a 50-year old person. On similar lines, Bitcoin rally could be irrational, based on hype, but the market is still in a nascent stage and thus expecting it behave like gold or other matured markets is irrational.

Most experts compare Bitcoin with gold and conclude the virtual currency is a nothing more than an illusion. However, I believe one needs to draw parallels between Bitcoin behaviour today and the price action in gold a thousand years ago [when gold was a toddler]

The hype led rallies do deflate. It would have happened with gold as well thousand years back. But that was not the end of the world for gold. On similar lines, Bitcoin’s hype-led rally could deflate, but that won’t be an end of the world for cryptos.

Thus, it is premature to call it a bubble. If the virtual currency penetrates deep into South East Asia and other young nations, it could easily gain credibility and challenge gold. No one can say for sure whether it will penetrate the key regions. So it is better to avoid taking extreme views - calling it a Holy Grail or once in a lift time bubble.

Technicals - Volume continues to disappoint

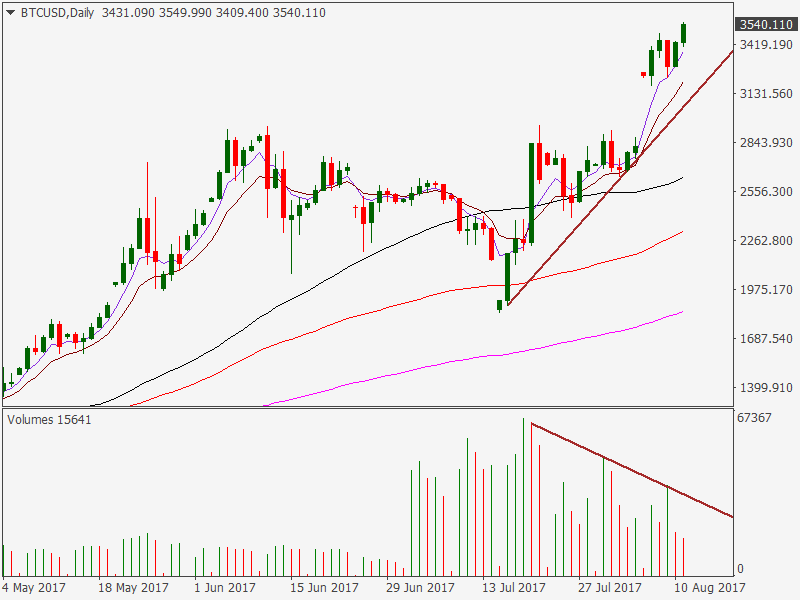

Daily chart

- The chart continues to show a bearish volume divergence. Hence, caution is advised as we may be in for a sudden pull back over the weekend, although the dips below 10-DMA could find takers, given the average is still sloping upwards.

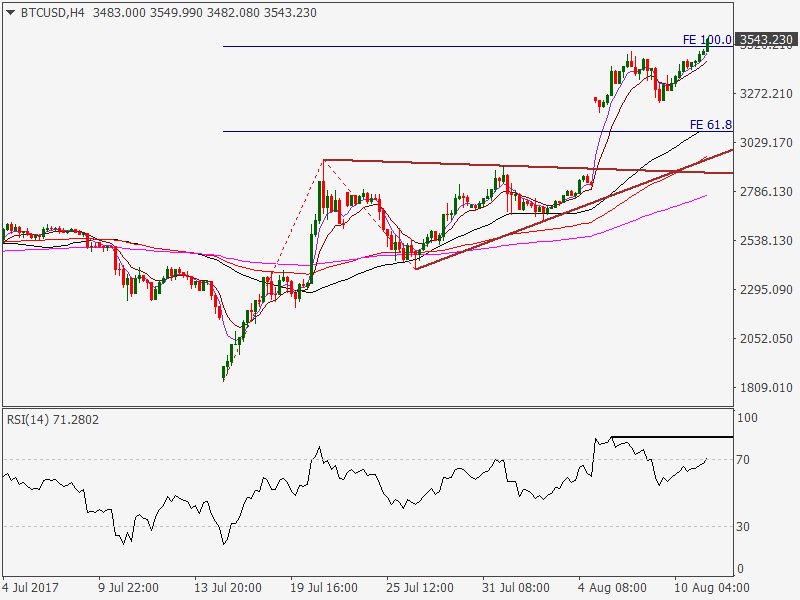

- However, a pullback triggered by a bearish price RSI divergence on the 4-hour chart could go much deeper… possibly towards $3000 levels.

4-Hour chart - Potential bearish RSI divergence

- Watch out for a lower high on the RSI as it would confirm a bearish divergence and open doors for a strong pull back towards $3000 levels.

- On the higher side, a major hurdle is seen directly at $3817 [100% Fib extension levels].

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.