The case for gold seems to have dried up significantly in the past 48 hours with all the economic news and data that has come out. Hyperinflation: not likely in the current US economy by the looks of things, as tapering has now come to an end for the USA after the FOMC meeting yesterday. But what about all the assets on the FED’s books? The FED has already said that it will hold the majority of it to maturity so that it does not cause an economic shock on the markets, like past events have had.

So where does this leave gold. Well, it leaves it on the outside looking in from here on out. Once the poster boy for fighting inflation and being the tangible asset that people could get their hands on, it’s now just the precious metal which is bleeding value by the day and looks likely to drift into the 1150-1100 area fairly quickly.

What has happened last night though was further pain for gold bulls as the US economy showed strong resilience with advanced GDP figures coming in at 3.5% q/q. While it was a drop on the previous quarters reading, it was much better than expected and bodes well for the growing strength of the economy as a whole. Even with a weaker unemployment claims reading, the market was still not turned off and buying of the USD and risk assets has increased.

So we have strong GDP figures, consumer sentiment at recent record highs and finally a robust labour market. Things don’t end well with gold, and the only thing that could possibly turn around golds fortunes would be some sort of calamity on a global scale. Think Putin, but with more bite, though even that seems highly unlikely.

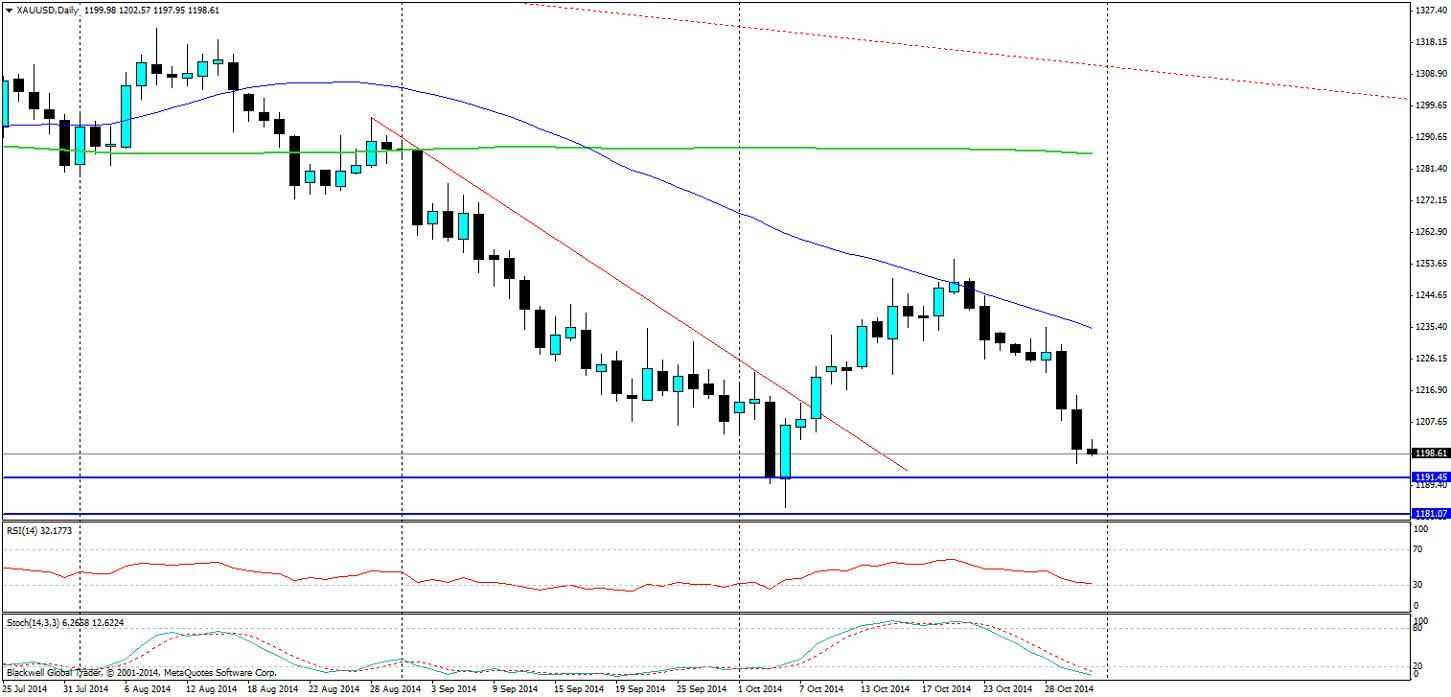

When it comes to levels to target there are two very clear support levels in the market at present. The first one can be found at 1191 and the second one can be found at 1181; this level will be the hardest to crack as it has been tested on 3 occasions now. However, a push through this level would send the bears into a frenzy in the market.

Overall gold looks to have had its day. There is no fundamental reasons in the markets for further rises and I believe that it’s just a matter of time before we see it drop below the 1100 mark. So if you are a gold bull it might be time to think twice in the current market climate.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETIEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK AND NOHYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTANL LOSSES OR TO ADHERE TO A PARTICULAR TRADINGPROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULT

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.