Traders, are you ready? The Battle for Westminster is upon us.

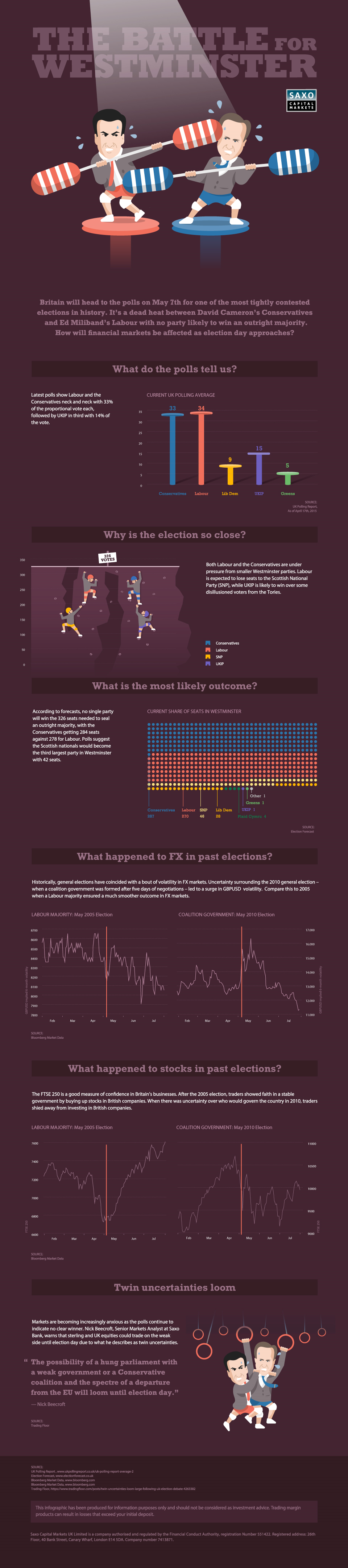

Britain will head to the polls on May 7th for one of the most tightly contested elections in history. It’s a dead heat between David Cameron’s Conservatives and Ed Miliband’s Labour Party with on party likely to win an outright majority. This can be an unsettling time for traders, especially if you have exposure to UK markets.

This infographic from Saxo Capital Markets attempts to explain just why investors should be cautious ahead of the election.

Unlike in the US – where the campaign trail tends to run for months, if not years – elections in the UK are concentrated into a matter of days. This tends to concentrate the event risk over a short period of time.

The UK’s first-past-the-post the system also means no single party can rule alone without 50.1% of the vote. With both Labour and the Conservatives failing shy of the 326 seats needed for a majority, a hung parliament could ensue with a multi-party coalition, minority government or a re-run of the election all potential outcomes.

A look at past elections shows that financial markets tend to experience far more volatility when the outcome of the election is uncertain. After the 2010 election when there was no clear winner and a coalition government was formed after 5 days of negotiations, sterling experienced a large bout of volatility. The FTSE 250 index, a good measure of business sentiment in the UK, also fell sharply during this period. Contrast this with the election in 2005 when Labour won a large majority and we can see volatility in sterling was much smoother – the FTSE 250 also rallied after the 2010 election.

In addition to the uncertainty surrounding the vote, there are a number of election outcomes that could affect certain sectors of the economy. For example, Labour’s pledge to freeze gas prices until 2017 could hurt utilities like Centrica and SSE should a Labour-led government come to power.

Nick Beecroft, Saxo Bank’s Senior Market Analyst, believes we could see even more volatility in FX markets this election, in part due to the twin uncertainties: a hung parliament with minority government combined with a departure from the EU under a Conservative-led coalition with UKIP. Whatever the outcome, the election will likely to come to the fore in early May.

With the Scottish referendum still fresh in the minds of investors, sterling volatility is creeping in. The cost of insuring against volatility sterling over the next month soared to the highest in more than three years. Market jitters may even be felt months after the election should a coalition government fail to establish confidence in financial markets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.