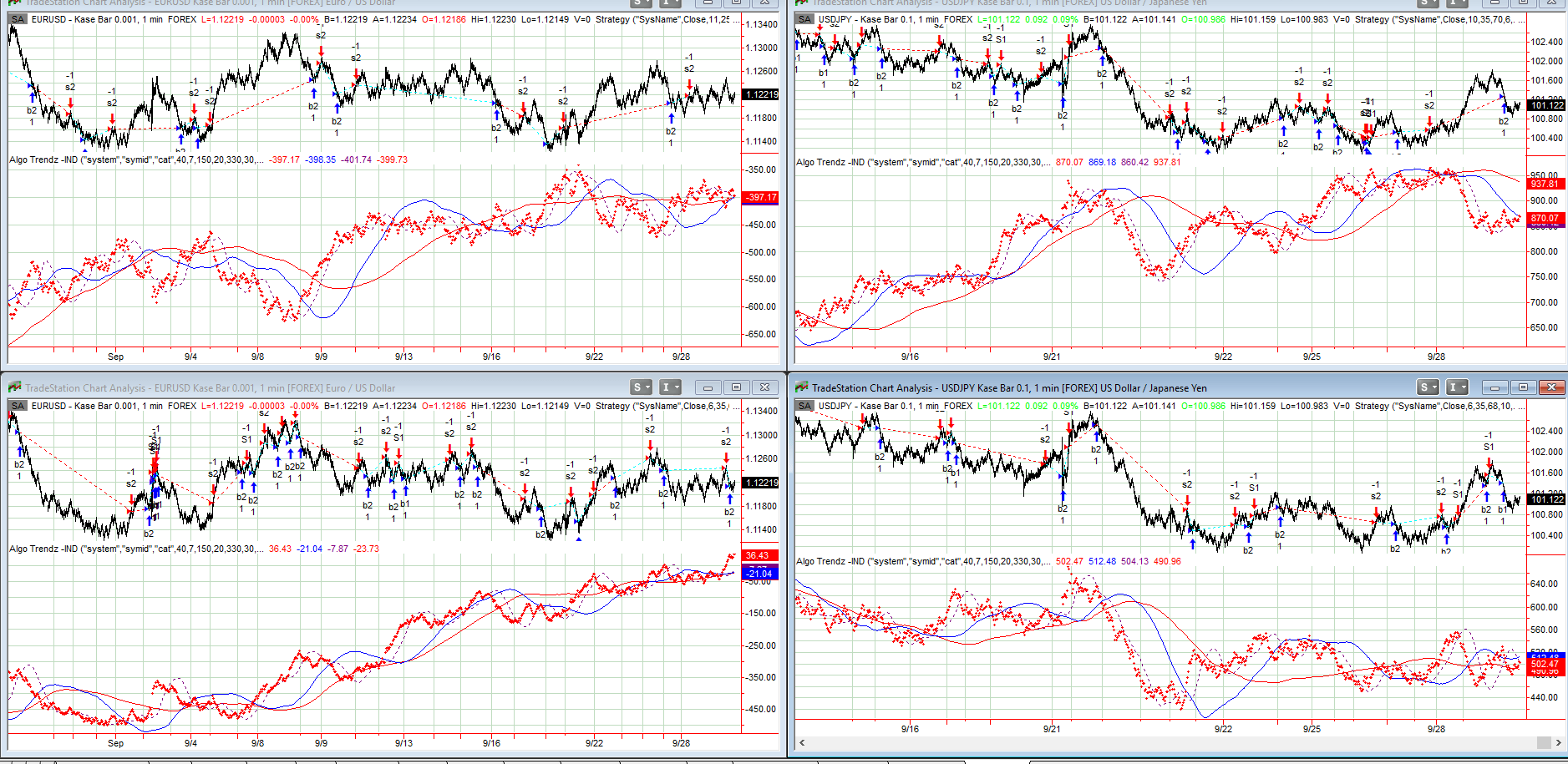

The charts are the short term bull bear series that I use to determine when a is reversing. Both pairs however are just sitting on the fence with no clear winner. The EUR bull model (bottom) is outperforming the bear but only small margins. The JPY bear has slipped over the past day and appears ready to see the pair rally so look for a short term pop in the JPY but be trading oriented with small ups and downs.

About the Bull/ Bear Algos – The bull bear short term algos are two trading systems that are short term oriented but each one is biased to a particular trend. The chart on the top is the Bear biased algo which means it tends to perform well in downward, choppy markets. The chart on the bottom is the bull biased algo and it tends to perform best when the trend is up and the market is choppy. The biased algo’s are also great for identifying when short term trends are about to change because the ALGO trends will begin to reverse. For more info on how to understand ALGO trends please visit The Index Strategist for background. These bull bear charts are available for EURUSD, USDJPY, Emini S&P, US 30 Yr Bonds, OIL and GOLD.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus.