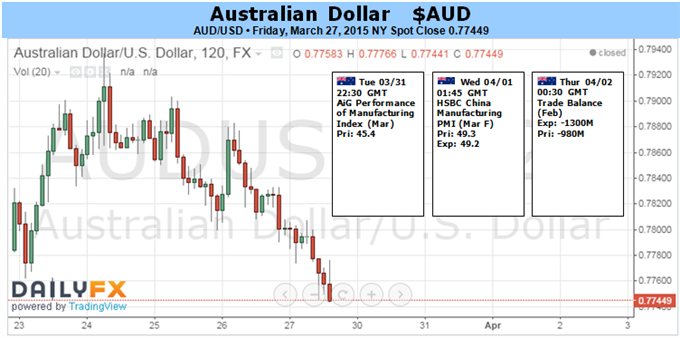

Fundamental Forecast for Australian Dollar: Neutral

- Aussie Dollar May Rise as Greece, Creditors Strike Bailout Funding Deal

- Firming Fed Rate Hike Bets May Cap Aussie Gains on Firm US Jobs Data

- Identify Critical Turning Points for the Australian Dollar with DailyFX SSI

Continued quiet on the domestic front is likely to see external forces as the dominant driver of Australian Dollar price action in the week ahead. The currency’s correlation with the MSCI World Stock Index has jumped to 0.68 (on 20-day percent-change correlation studies), the highest since November 2013. That points to an acute sensitivity to market-wide sentiment trends, warning that the breakout of risk aversion will send the Aussie lower while a pickup in investors’ mood will deliver the opposite result.

The spotlight initially falls on Greece. The government submitted a list of proposed reforms that it hopes will unlock the next round of bailout funding on Friday. The so-called “institutions” representing Greece’s creditors – the EU, the ECB and the IMF – will evaluate the plan over the weekend, with a decision expected on Monday. Athens faces €5.8 billion in maturing debt this month in addition to the on-going expense of running the country.

Investors fear that if external funding is not secured, a cash crunch and subsequent default may lead to the country’s exit from the Eurozone. Such an outcome would be unprecedented, carrying with as-yet unknown implications for the financial markets at large. Avoiding that trajectory with an accord that keeps Greece within the currency bloc is likely to prove supportive for risk appetite as well as the Aussie Dollar. Needless to say, failing to reach a deal stands to produce the opposite response.

Both sides of the negotiation are ultimately interested in a deal. Greek Prime Minister Alexis Tsipras and company surely realize that sticking to their campaign promise of ending austerity at the cost of disorderly redenomination will probably compound the country’s economic woes and likely cost them their jobs. Meanwhile, EU and IMF officials no doubt prefer to avoid a “Grexit” scenario for fear of the precedent it may establish, particularly in larger countries with strong anti-austerity movements such as Spain. On balance, this means that some kind of accommodation is probably more likely than not.

Thereafter, Federal Reserve monetary policy expectations return to the forefront. The week ahead will deliver a slew of high-profile economic data releases culminating in the March edition of the Employment report. The economy is expected to add 248,000 jobs while the unemployment rate is seen holding at 5.5 percent, a level broadly associated with “full employment” (a level such that reducing joblessness further would pressure inflation upward).

US labor-market data has bucked the trend of otherwise lackluster news-flow relative to expectations over recent months. Another upside surprise may rekindle bets that the Fed may move to raise rates by mid-year. The prospect of relatively sooner stimulus withdrawal is likely to weigh on sentiment considering the formative role of QE-linked funding in supporting risky assets in the years since the 2008-9 crisis. That means an upbeat payrolls reading stands to hurt the Aussie, and vice versa.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.