I'd posit it is the biggest week of the year in terms of central bank announcements and data releases and I'd suggest that by the end of this week we may not still be any clearer necessarily on where the Fed is at with regard to the Septaper (unless non-farm payrolls is weak).

Before we have a look at those though lets look back to Friday.

The Hilsenrath Impact continued on Friday for the US dollar which continues on the back foot against the Euro (1.3285), Sterling (1.5381), Yen (98.09) and the Aussie (0.9250). Key driver is the expectation that the Fed will be dovish again this week but I reckon they will continue to nuance the message about the difference between the taper and interest rates. This is a difficult task and will be extremely important over the week because the market is heavily long USD's and short Aussie, Yen and GBP in particular.

The US stock market on Friday opened weak but managed to eke out small gains with a strong rally on the jump in the Michigan Consumer sentiment data. At the Close the Dow (+3 pts 15,559), the S&P 500 (+2 pts 1692) and Nasdaq (+8pts 3613) snuck into the black although Europe was more mixed with the FTSE (-0.5%), DAX (-0.65%) and FTSEMIB (-0.06%) were all down while the CAC managed to rally 0.33% and Spain was 0.89% higher.

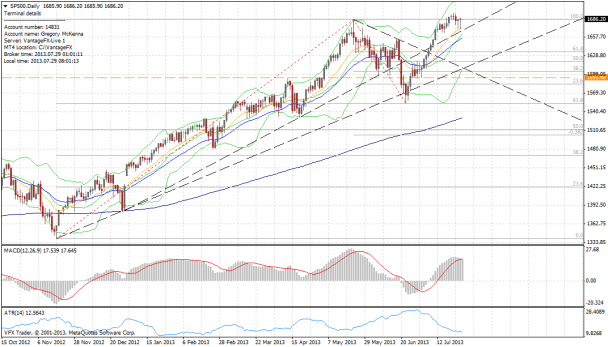

Worth noting is that based on my usual discretionary system, as opposed to my modified Turtle system that got me long Friday week back, the S&P (and the DAX et al) looks like it has topped out.

Clearly last week was one of tooing and froing as you can see on the long tails on the daily bars above. My stop on the modified turtle is 1663 now and if this breaks it would trigger me into a discretionary short.

On commodity markets Gold also recovered from early losses ($1333.35 oz.) but like the S&P it too is dancing around at the waiting on the next catalyst higher. A break back below $1308 could get ugly this week while a break above $1345 should kick it to the next level. Crude retested the line it broke up and through and has held for the past couple of weeks and a fall below $103. 89 opens up a big fall. Our friends Corn and Soybeans were a bit more quiet than recently only falling 0.81% and 0.41%. Dr copper was 2.49% lower as fears continue to grow about the outlook for Chinese growth and particularly because the Chinese Investment Corporation has, in the words of the FT, " switched emphasis away from commodities to financial stocks in its overseas equity holdings over the past year" - FT article here.

Now a quick look at the data this week. We have the Bank of England, ECB and the Fed all having their meetings and announcing the results of same. We get the preliminary read on US Q2 GDP and then at the end of the week we get non-farm payrolls in the US.

It is a critical time for the Fed - they are likely to want to reinforce the clear distinction between taper and interest rates but i strongly believe that they are also likely to reinforce that the taper is a prudent step to begin soon. Certainly Hilsenrath's article last Thursday suggested a certain dovishness from the Fed but he got it wrong just before the last FOMC meeting so he is possibly as much the Oracle of nowhere as much as he is the Oracle of Liberty Street.

We'll know later this week but complicating things just a few hours before the Fed announcement is the US GDP for Q2 which is expected to slow to an annualised 1.2%.

Equally important now that Mark Carney has had time to get his feet under the desk is the message we get from the ECB about rates. Many expected he would hit the ground running at his first meeting but this belies the very nature of central bankers even ones as forward looking as Carney. But his second meeting is a very different kettle of fish. GBP has been gently gaining against the USD recently and Carney may want to be rid of that trend and it is clear that outside London the UK economy still needs considerable stimulus.

Likewise in Europe the ECB will be concerned that the Chinese slowdown is going to have material impacts on them even if the PMI's have been a little better lately. So we'd expect some dovishness there too. That's not to say its all bad in Europe because the data has been beating expectations but a weaker China means a weaker Germany.

Then of course at the end of the week we get non-farm payrolls with the market expecting +184k according to FX Street.

It is a big week of announcements of data - the single biggest week on this basis probably all year because of both the convergence of data and where we are in the debate about the Fed.

For traders there is chance of great reward but also great risk - knowing your systems and your stops will be a must to end this week in the black.

But the key thing for me is that we have an Aussie dollar within sight of the top of its 90-93.30/50 range. We have an S&P near its all time high but starting to look a bit wobbly and we have a similar setup in the DAX in particular and the FTSE to a certain degree. We have gold looking like it might have had a false break but still pointing higher and we have crude which might just have topped for this run higher.

We also have FX speculators that are still long US dollars and very short Aussie dollars and Yen. It is a set up for volatility, it is a setup for making losses and it is a set-up for some big and sustainable breaks in either direction if it happens.

Over the weekend in my weekly newsletter I quoted David Einhorn as saying that his firm had cut back positions because it saw volatility coming and wanted to take advantage of it. It is a prudent message for all of us who trade as this week we could be right as many times as we are wrong or even more but still lose money because the market whip saws.

Time to don the helmet and be careful.

Have a good day

Greg

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.