It is sad to say but it is true that the IMF is not an especially credible organisation when it comes to forecasts - not in the specifics anyway. I know I overuse the word panglossian and I know I use it as a pejorative but the IMF strikes me as both panglossian in its outlook for growth more often than not and until recently doctrinaire in its prescriptions for lack of growth and economic weakness. I always struggle to square that circle but what I will say I like the IMF's Chief Economist Olivier Blanchard and when he speaks I generally listen.

So when he talked about thepatchiness of growth in the world and particularly the BRICS and the challengesahead for them I took note overnight. Blanchard was reported by the FT assaying,

If you look country by countryit seems to be specific...so in China it looks like unproductive investment, inBrazil it looks like low investment and in India it looks like policy andadministrative uncertainty

Now of course my main focus ison China because as I have written in the weekly for a while now I believe thePresident, Premier and PBOC are seeking to execute a slowdown in China so as toreorganise its growth profile towards something more productive, sustainableand fairer for the wider Chinese population. So of course the risk is thatChina undershoots its own growth targets and certainly the IMF's expectation of7.7% for China seems heroic and likely to be further revised down sharply. Thisis a double whammy because of the relationship between Chinese growth andGerman exports over the past decade especially the past 5 years so China andEurope continue to worry me longer term and pose risks for the Aussie dollarand the Australian economy.

But equally important overnightwas the overall downgrade to growth that we saw because even though I think theIMF is late on the scene with this downgrade they are right to be highlightingthe fact that the global growth profile is once again and substantiallyweakening.

I think it is important to giveas full a detail of the IMF downgrade as possible for this growth outlook asthis downgrade reminds me of 2008 and 2009 when things slid away during theyear and growth was consistently and constantly downgraded. So you can read thefull press release here andthe a fair chunk of the executive summary is below.

Global growth is projected toremain subdued at slightly above 3 percent in 2013, the same as in 2012. Thisis less than forecast in the April 2013 World Economic Outlook (WEO), driven toa large extent by appreciably weaker domestic demand and slower growth inseveral key emerging market economies, as well as by a more protractedrecession in the euro area. Downside risks to global growth prospects stilldominate: while old risks remain, new risks have emerged, including thepossibility of a longer growth slowdown in emerging market economies,especially given risks of lower potential growth, slowing credit, and possiblytighter financial conditions if the anticipated unwinding of monetary policystimulus in the United States leads to sustained capital flow reversals.

For FX traders though as Olivier Blanchard said in the quote above a certain specificity is creeping into markets which is great for traders and asset allocators because it means everything isn't correlating to 1 and we saw that last night when the Australian dollar rallying strongly after yesterday's selloff to 0.9080 before a rally and selloff and rally and bit of a selloff to sit at 0.9167 at the moment.

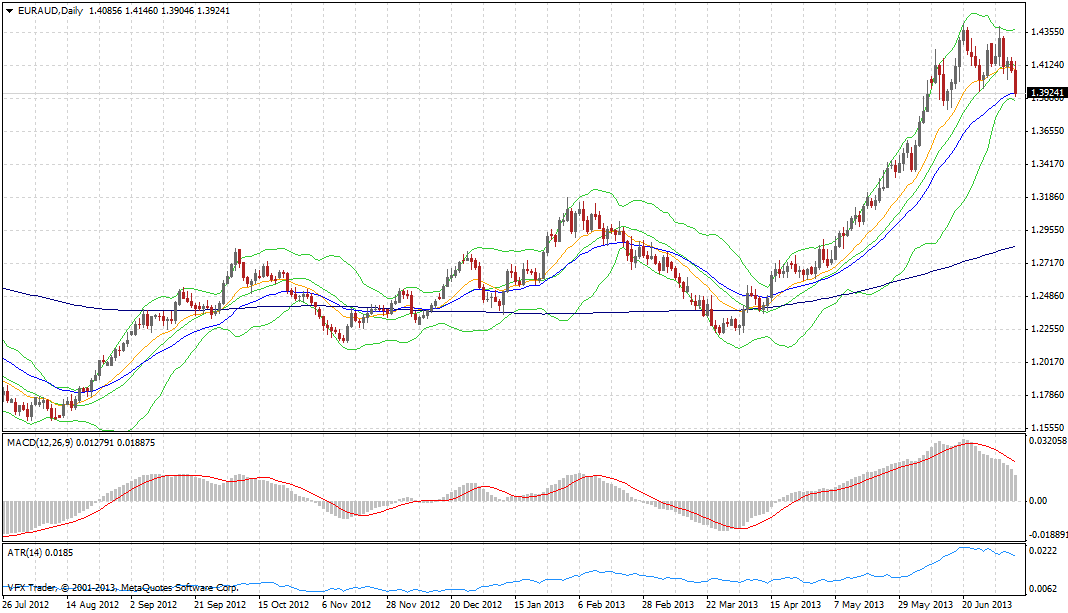

You can see the specificity in the EURAUD cross above which is sitting around 1.39 this morning likely to test range support at 1.38 which if it breaks opens the way to 1.3570.

On the Aussie specifically I made money selling twice yesterday at opportune times using the hourlies but as I noted if the Aussie was able to build on the daily close of the previous day it might be able to rally a little against the USD. 0.9217 is key short term resistance and if that breaks maybe a 1 cent run higher. I'll probably sell into the rally if it occurs short term while below 17 and if you missed the NAB business survey yesterday check out this link from MacroBusiness yesterday on the survey - if there isn't a couple of rate cuts in this survey I'd be very very very surprised.

Turning now to the Euro and Pound, or should I say Pound first we see exactly the type of thing the IMF is talking about. UK industrial and Manufacturing production released last night for May both missed badly printing -2.3% and -2.9% respectively for the YoY results. This knocked GBP for six and off its highs around 1.4980 falling to a low around 1.4812 before recovering a bit to 1.4870 as I write. I have a sell stop in for a break of 1.48 which I believe will pressage a much deeper move.For the moment though it might find a little support again in front of 1.48.

Euro also had a shocker knocked from a high of 1.2998 to a low of 1.2754 by comments from ECB executive board member Jörg Asmussen that rates were going to be kept low for at least 12 months. Of course coming after the comments from ECB Boss Mario Draghi tha trates would be accomodative for an extended period this simply reinforces,along with the IMF outlook and recent German data, the stark contrast between the path of European and US monetary policy. Euro is now focused toward a run at 1.2660 in the days and week ahead. Resistance is 1.2804.

But stocks don't care about growth - no growth is good because it means rates are low forever and free money remains available for longer. Equally important in the US overnight however is that apparently, based on news wire reports, many traders reckon that the earnings numbers might have been downgraded far enough or too far and as a result the chances of companies reporting better than expected revenues and sales have increased. It is about slights or hand and expectations and Keynes beauty parade so this might be right and I have not the specific knowledge to judge one way or the other.

What I do know however is that the S&P 500 has now taken out both resistance trendlines in the past couple of days and is not too far from its all time high. Personally I would like to see a run at it as I believe this would complete the trend a move to 1685 would complete this move.

At the close the Dow was up 0.49%, the Nasdaq rose 0.55% and the S&P up 0.70%. In Europe the FTSE managed to rally 0.98% which you have to question on rational grounds but far be it for me to ever say investors or markets are rational. The DAX was up 1.12%, the CAC up 0.53% whilc stocks in Milan and Madrid were down a tiny amount.

Adding to the negative growth outlook is the buoyant USD Crude oil price at $104.52 (+1.34% overnight)which I see as a very big handbrake on growth globally and a big risk going forward. On other markets Gold was 0.89% higher at 1247 but it is off the 1256 level just before the Euro and GBP got smashed. Corn was 1. 77% higher,Wheat 2.34% and Soybeans rose 0.25%.

Data

Today we get South Korean employment data, Westpac Consumer Confidence in Australia and then important Chinese trade data, new loans and foreign reserves. CPI in Germany is out also on Wednesday along with industrial production in Italy. In the US its the FOMC minutes which will have the tea leave readers like me pouring all over them.

Twitter: Greg McKenna

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.