It all kicked off on Saturday with better than expected NBS Chinese Manufacturing PMI which was at 50.8 both better than expected but also higher than the previous month. This has helped the Aussie rally 30-40 points from Saturday mornings pre-release close but the relaity is that with such a big day of data we'll know by this time tomorrow which way the markets are headed.

Looking back on Friday's data it is clear in the US that consumers are struggling with a lack of wages growth. Indeed it seems the key behind the fall in US stocks and the worries that are gripping investors is that the talk of tapering in the Fed's purchases of bonds is at odds with the data that seems to be flowing in the US economy and a lack of self sustainability in the economic recovery. Take Friday's core personal expenditure data which was flat month on month and up only 1.1% year on year with the full numbers printing -0.3% and 0.7% respectively. Hard for a recovery based on consumers to continue when spending is stagnant or weak.

Remember the construction of GDP numbers requires the C+I+G+(X-M) grows each period otherwise GDP goes backwards and in that construction you can see why Q1 growth in the US was just 0.6% (2.4% annualised). Indeed over the weekend the head of the ECRI who said the US went into recession last year was on the hustings pushing his case asking the question of how spending is going to grow without income growth - it's a very good question.

Anyway at the close we saw stocks under pressure with US markets closing on their lows with the Dow down 1.36% or 209 points at 15,116, the S&P 500 was in our support zone at 1,631 down 23 points or 1.42% and the Nasdaq was 1.01% lower. In Europe the FTSE dropped 1.11%, the DAX was 0.61% lower and the CAC fell 1.18%. In Italy stocks were down 0.79% while in Madrid they fell 1.33%.

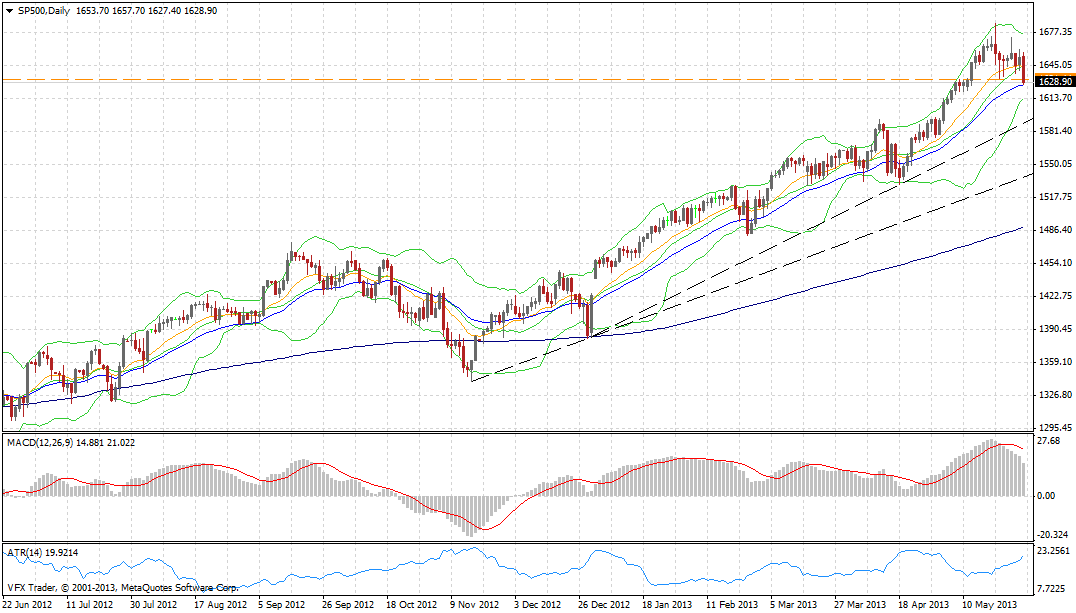

As you can see in the S&P 500 chart from my VantageFX MT4 platform the S&P is in the support zone I have highlighted recently and a break of 1,620 opens up a 40+ point retracement. Based on my usual trading style and system the S&P is headed lower.

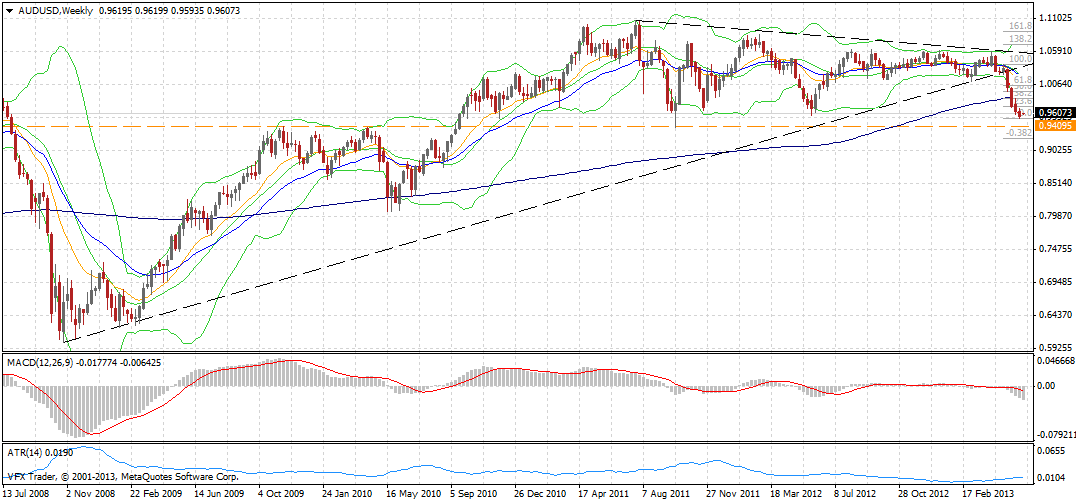

on the Australian dollar it is a bit of a messy open this morning and the 7am open of MT4 has been a bit frantic with Aussie trading a 20+ point range already. The Main thing I would say about the Aussie Dollar is that we now know there is plenty of selling in front of 97 cents and whether or not that selling remains will largely depend on the data flow for the week - the weekly close below 96 cents however was pretty weak but closing in on very important support.

Key levels are 0.9525 and then 0.94 on the bottom side with 0.94 massive support. Topside it is 0.9780 and then 0.9870 the latter of which is just a garden variety 38.2% retracement off the recent low. The dialies continue to suggest that the Aussie will find support in this 0.94-95 region for the moment.

Elsewhere in FX land the Euro has two levels to watch if either 1.3070/80 or 1.2840 give way. And USDJPY - well its almost tested support I was looking for at 99.90/100 with a low of 100.21 overnight but this zone is key. If it breaks it could get very interesting for both the USDJPY and the Nikkei.

On Commodity markets Nymex crude fell 1.75%, gold was off 1.34%, silcver fell 1.97% and copper was down 0.65%. Corn, wheat and Soybeans were up 1.18% and then 0.95% and 0.97% repectively.

Data

A heavy data load on Today which sees the release in China of non-manufacturing PMI and the HSBC manufacturing PMI, TD inflation in Australia as well as Australian Gross operating profits, retail sales, the RBA Commodity index and then it is onto Europe and the US with the Markit Manufacturing PMI's.

Twitter: Greg McKenna

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.