Right, but also wrong.

That's the way I feel about the note on the AUDUSD I wrote yesterday. Lower levels did beckon as I suggested but I failed to realise that the stuff I wrote about yesterday that some of the protagonists in the Italian political saga had already started to walk back their positions wasn't wildly appreciated by traders.

So, the Aussie’s dip into the 0.7470/75 support zone was short lived and once the news broke that Italian President Mattarella didn't want a summer election and other news about the protagonists walk back hit the headlines again the Aussie went along with the rally in the Euro and risk assets.

And this morning it is up more than a per cent on the day from this time yesterday at 0.7575.

So, to know where the Aussie might head it's worth rehashing where it has been recently.

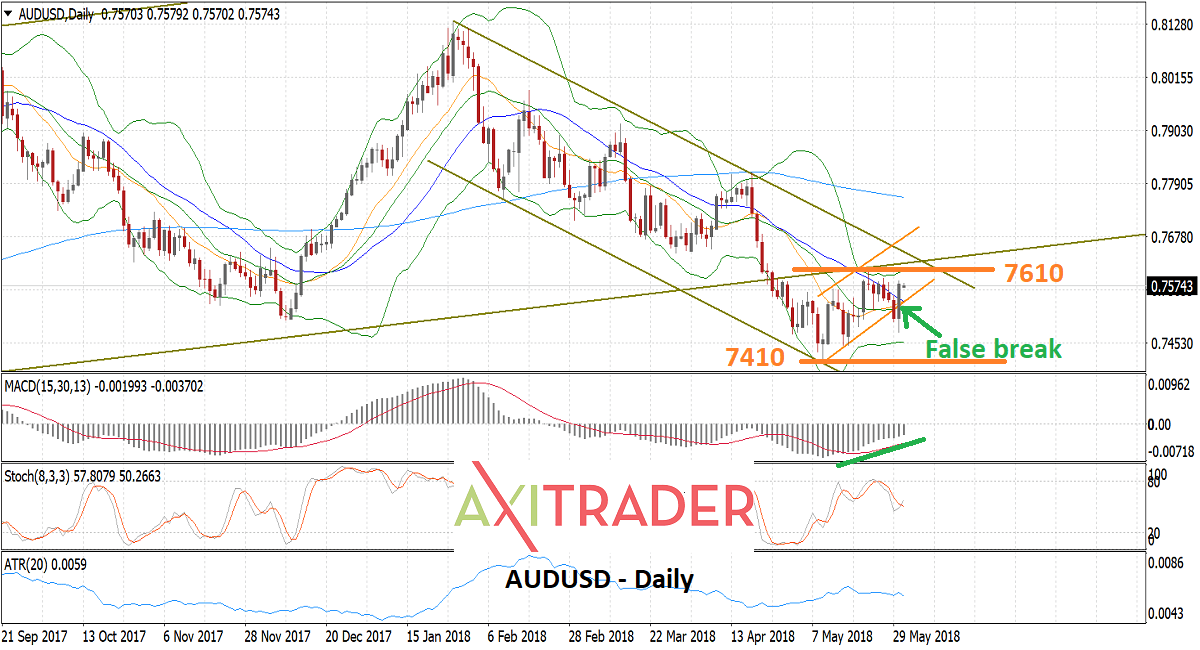

Two days ago, the Aussie looked like it might challenge the top of this 2-cent range between 74.10 and 76.10 cents. Yesterday the chances where it would approach the bottom of the range with the concerns over Italy and the risk off tone. Today it looks again like it might test the top of the range.

You can see in those few sentences that the Aussie dollar remains hostage to movements offshore and is ebbing and flowing with the moves in overseas markets or more correctly the appetite for risk from global investors as it ebbs and flows with the risks that have arisen and seemingly faded again. But it hasn’t broken the range yet.

Today could be the day local data comes back to the fore though. There is plenty of global data but of most import is the local CapEx number for Q1 which will feed into GDP. It’s a complex number to evaluate though because we get the number that feeds into GDP – expected to be +0.7% the Reuters poll says – and we also get forecasts for future investment. So watch that space at 11.30am and then the NBS PMI’s for China a little later this morning.

It might also be worth keeping an eye on Chinese stocks - the Shanghai composite is at a very important juncture.

Key levels on the day are 0.7600/10 then 0.7630 and 0.7660. Support is 0.7545, 25, 00 and 0.7470/75.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.