The ruling party of PM Abe won a majority in the weekend elections, but not the landslide that many had predicted. USD/JPY is trying to figure out how to react to what should be a bullish event but with a market already sitting on substantial long positions.

A decision by the Federal Reserve to review its 2003 ruling allowing banks to trade in physical commodities could also have far-reaching implications. Commodity markets will obviously become more volatile if the banks activity is curtailed and equity markets will be affected by the impact on the bank’s bottom line.

The PBOC scrapped the floor on lending rates over the weekend, another step in the direction of a more market orientated system.

Finally press reports in Australia suggest that a rate cut in August is almost certain and that Treasury will downgrade GDP forecasts.

USD/JPY has been reasonably volatile this morning, up and down inside a 50 pip range, but the overall range edges are still holding. Buying dips rather than breaks is still the preferred strategy.

EUR/JPY is targeting important daily highs at 133.80.

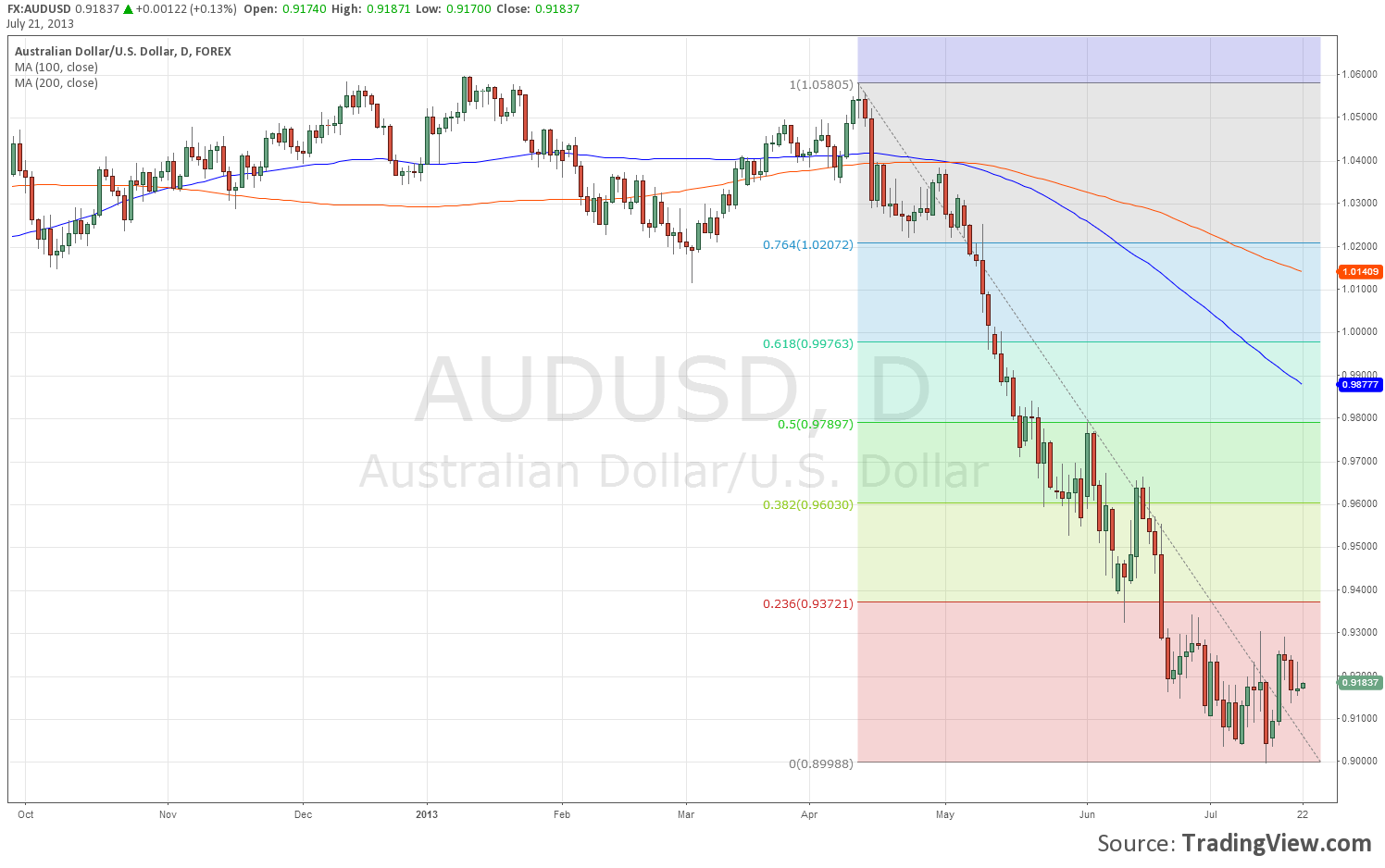

AUD/USD is trading inside obvious parameters at .9000/.9350 but the main factor here for me is the heavily oversold dailies and I still expect to see a minimum retracement towards .9600 in coming weeks. On the day, resistance should be solid at .9260 with support levels starting at .9140.

AUD/NZD has bounced back above 1.1600 after the Wellington earthquake but still looks to be stuck in a 1.1500/1.1800 range.

EUR/USD is once again back in range trading mode inside a 1.30/1.32 range but I am maintaining my bullish bias for an eventual break higher (at current rate that could be in 2020!!).

EUR/GBP is sitting on previous support at .8600 and EUR/CHF has gone to sleep again near 1.2375.

Good luck today.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.