The only data of note on today’s economic calendar are the New Zealand trades in early morning and the Australian business and consumer confidence in late morning.

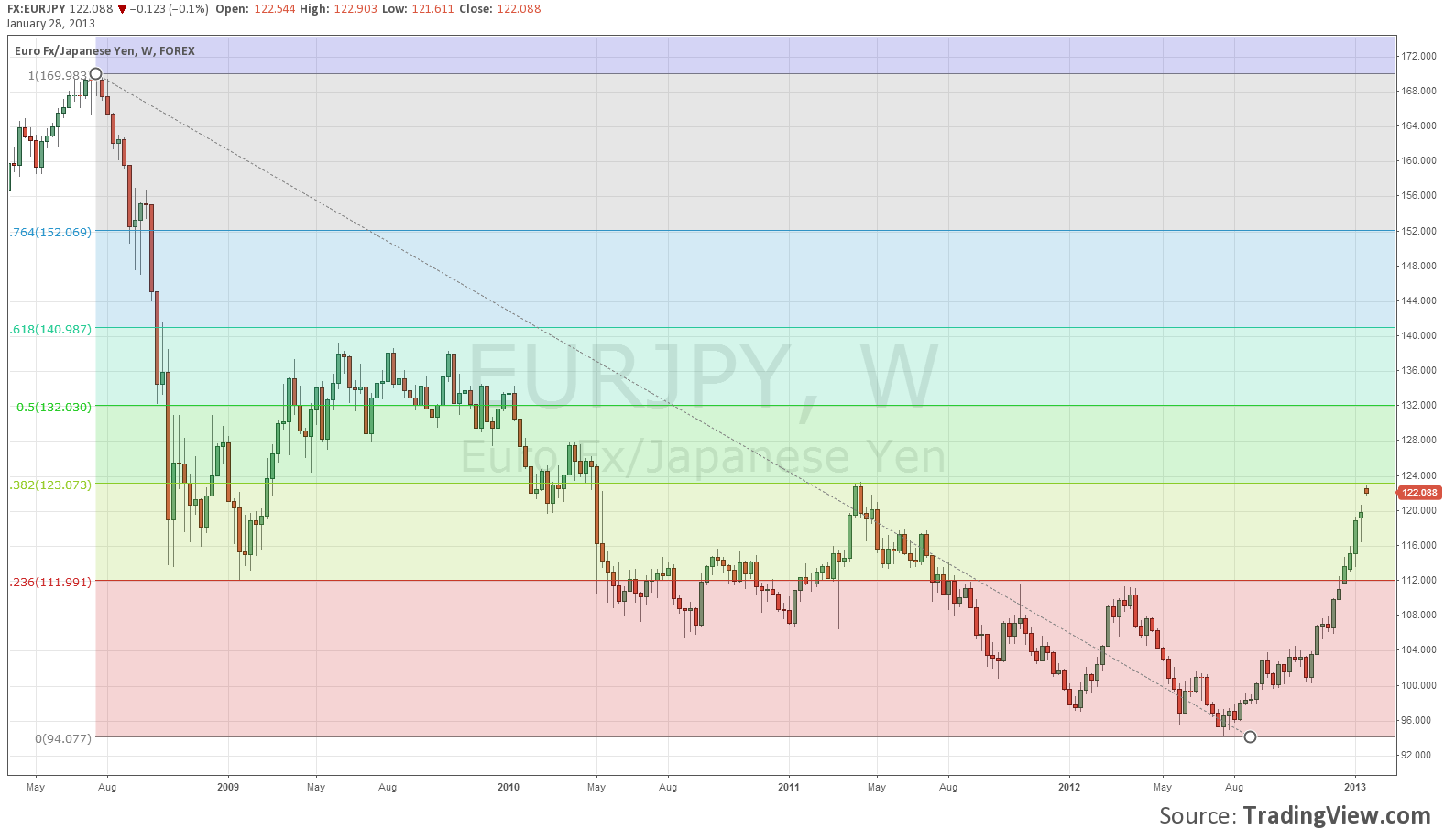

EUR/JPY will again be the lead pair in Asia and there is major technical resistance at 123.10/20 which will be closely watched (see chart). This level is the 38.2% of the big fall from 170 to 94, as well as a weekly high. There is also talk of barrier protection at 123.00.

EUR/USD is also consolidating recent gains and looks likely to range trade between 1.34 and 1.35 for this session at least. A previous hourly high near 1.3400 provides the technical support level (see chart) and optionality as well as Sovereign offers near 1.3500 should provide a cap.

USD/JPY is consolidating above the important psychological level at 90.00 and bears will be keen to reclaim it. But with momentum definitely bullish, buying dips seems the logical trade. Most analysts who were bearish at 78 are now super bullish, so maybe a top is about to develop!

The GBP remained weak, touching .8585 against the EUR and losing ground against all other majors. Sentiment is weak and with no sign of any major buyers, there seems little point in fighting the trend.

The AUD/USD traded quietly above 1.0400 after a few attempts at breaking lower. Interbank reports suggest that asset managers in particular are still keen buyers on dips, so we may simply be in a range-trading phase yet again. I’m still overall bearish but I’m not going to chase it lower.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD recovers to 1.0650, focus shifts to ECB/ Fed speeches

EUR/USD is advancing to near 1.0650 in European trading on Wednesday. The US Dollar sees a modest retreat, helping the pair recover previous losses. The EUR/USD rebound, however, appears limited amid Fed-ECB policy divergence. ECB and Fed speeches eyed.

GBP/USD clings to recovery gains above 1.2450 after UK inflation data

GBP/USD is holding onto the latest upside above 1.2450 in the European session on Wednesday. The UK's ONS reported that the annual inflation edged lower to 3.2% in March. This reading beat the market expectation of 3.1% and helped Pound Sterling stay afloat.

Gold price turns sideways as Fed Powell hawkish guidance limits upside

Gold price balances below $2,400 in Wednesday’s European session. The precious metal struggles to recapture new all-time highs around $2,430 as Fed Chair Jerome Powell emphasised maintaining the restrictive policy framework for a longer period.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.