EUR/JPY volatility is sure to remain high and I think we could easily get 200 pip moves in either direction. Any dips towards the trend channel base near 118.00 (see chart) are likely to attract plenty of buyers but with the market already quite short of Yen(and maybe getting a bit unsure of the EUR), any decent rallies will bring the profit takers flocking. I’d play a 118/122 range and be ready for plenty of swing trading.

USD/JPY has steadied near 90.00 and most of the interest has been in the cross pairs in recent times. The up-trend does seem to be slowing down here so I suspect that we may be a bit overbought near current levels (see chart). I’m looking to play an 88.50/90.50 type range but certainly do prefer buying the big-dip play.

EUR/USD is on the sidelines, being driven by cross plays in EUR/JPY, EUR/CHF, and EUR/GBP. I’m pretty confident that we are still in medium term range trading mode inside a broad 1.30/1.36 range so plenty of patience is required for the pure EUR/USD trader.

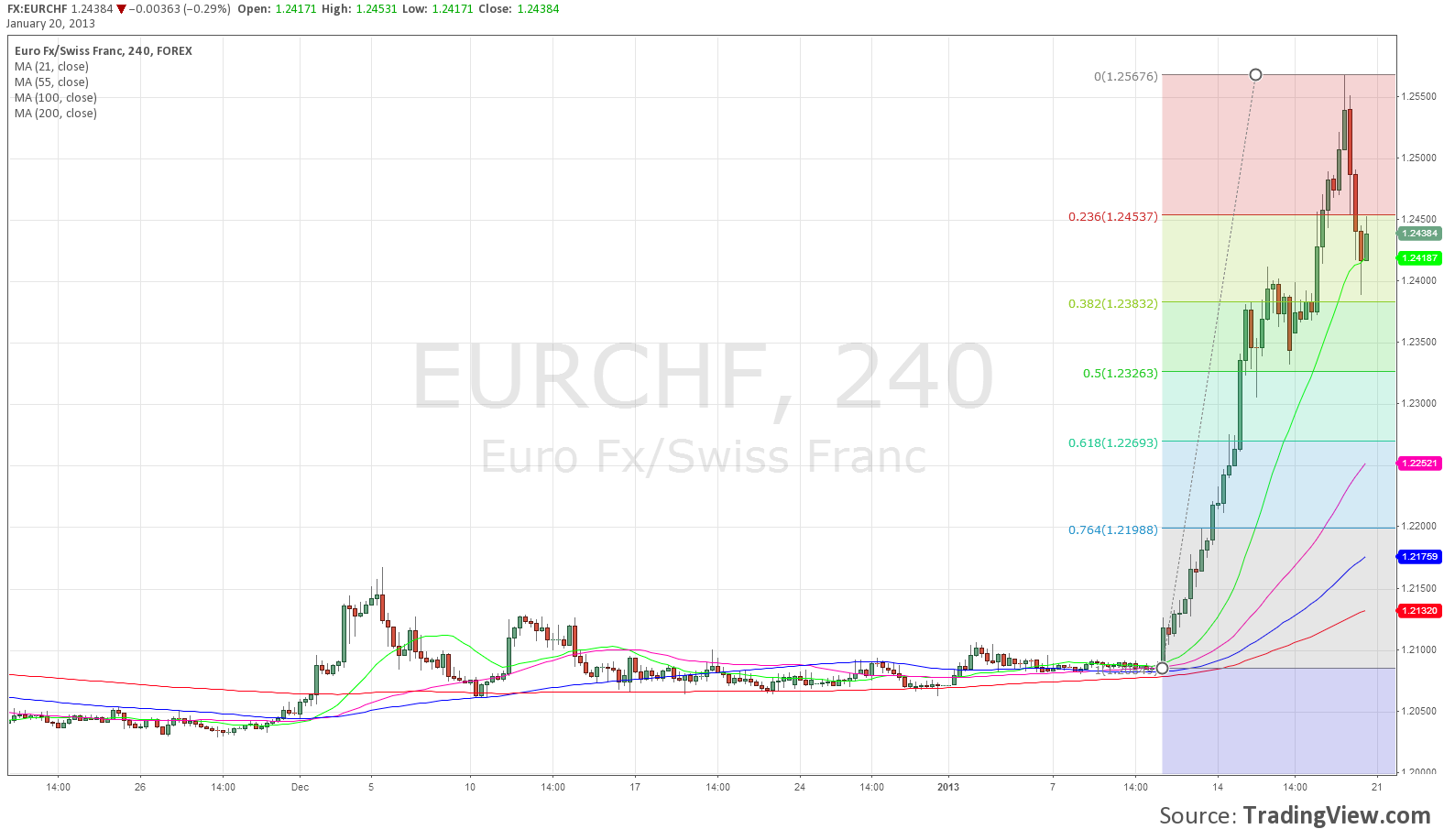

EUR/CHF got hit with a sharp bout of profit taking, falling from 1.2565 to 1.2385. This was a 38.2% retracement (see chart) so it will attract buyers now as well as trailing stops below. I’d look for a few sessions of consolidation inside of this range.

Cable got hit hard on Friday, with the double-whammy of continued EUR/GBP strength as well as a stronger USD. This pair has been range trading for so long now that I’m wary of getting overly bearish near range lows, but caution is certainly warranted when GBP sentiment starts to turn sour. As the old adage goes, “it’s never too late to sell sterling!”

The AUD is sidelined and still playing a 1.0450/1.0600 range, with most interest elsewhere.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.