The Swiss franc decline has been accelerating since last week. Bitcoin rushed above the important resistance at $5300. EURUSD stays close to 1.1250 in anticipation of the further signals. Oil rewrites 6-months highs.

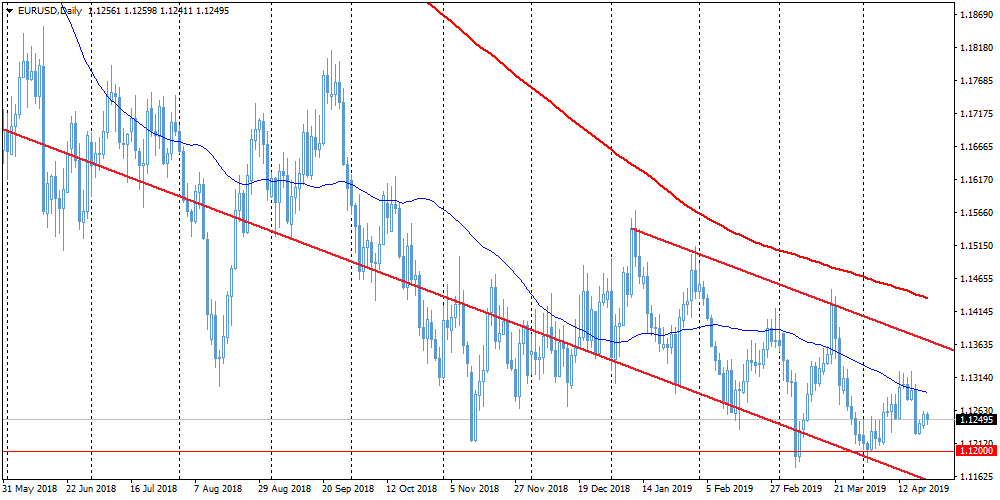

EURUSD

The most important currency pair on Forex market stay near 1.1250 in anticipation of further signals. Among the macroeconomic publications can be singled out another portion of disappointing U.S. data. Existing home sales decreased by 4.9% against expected drop by 3.8%. Last week also marked the fall of Building permits and Housing starts, contrary to expectations of growth. Today, the New Home Sales are in the markets' focus. Weak statistics can bring the pressure back to the dollar because of fears that the weakness of the housing market is evidence of a weakening of economic activity.

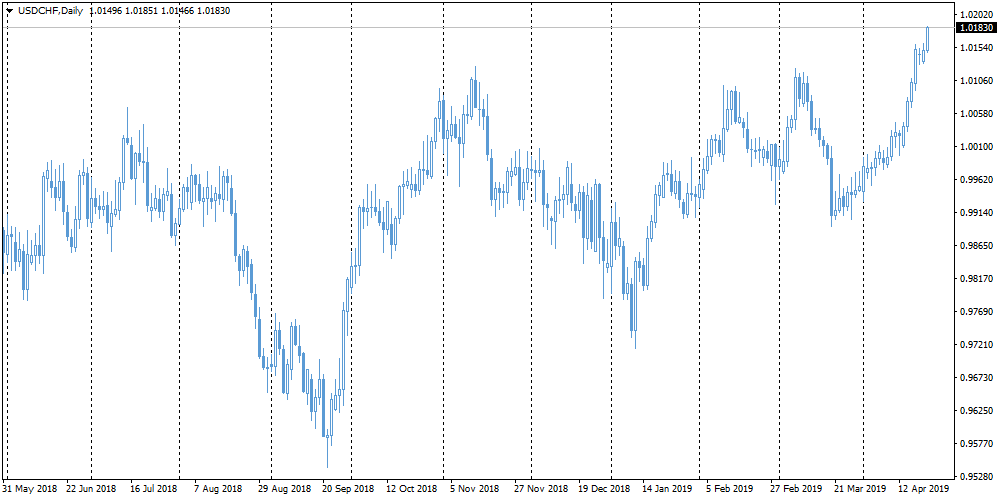

USDCHF

The Swiss franc has been falling over the last month, increasing the decline since the beginning of last week. USDCHF is growing for the fifth week in a row to January 2017 highs, adding 2.6%. The franc was under pressure because of increased traction in risky assets. Moreover, the Swiss currency suffered from the worsening of the eurozone. The third factor is that the pair went beyond the established trading range, that triggered the stop orders and increased the pair growth. The impact of these factors can put in the sight of market players levels near 1.03, which the pair reached at the end of 2016.

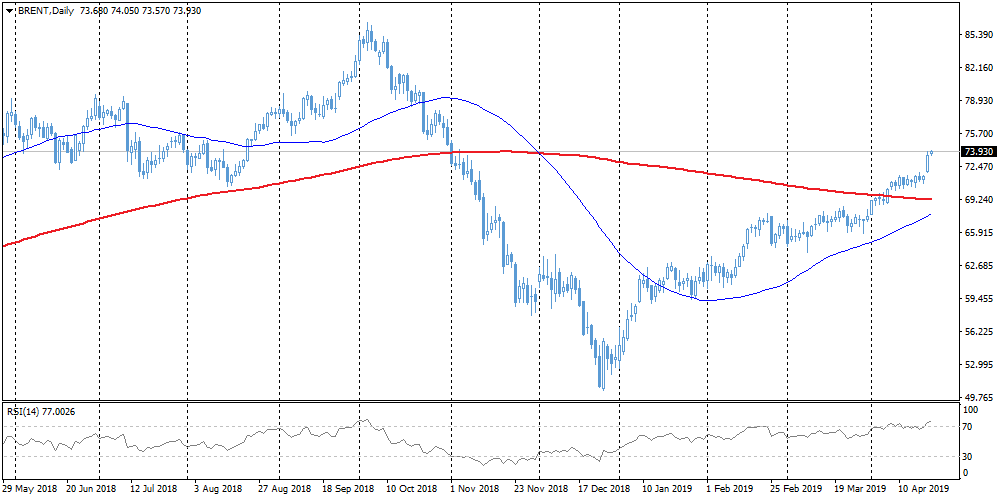

Brent

Oil adds about 3% this week, rewriting almost 6 months. Brent this morning has touched $74.00 per barrel, and the American WTI has exceeded $66 on fears around possible oil deficit after supply worries around Iran and Venezuela. The relative strength index is near the maximum levels since October last year, when oil prices were near their peak levels. High values RSI increases worries about further growth, increasing the chances of corrective rollback after the growth stops.

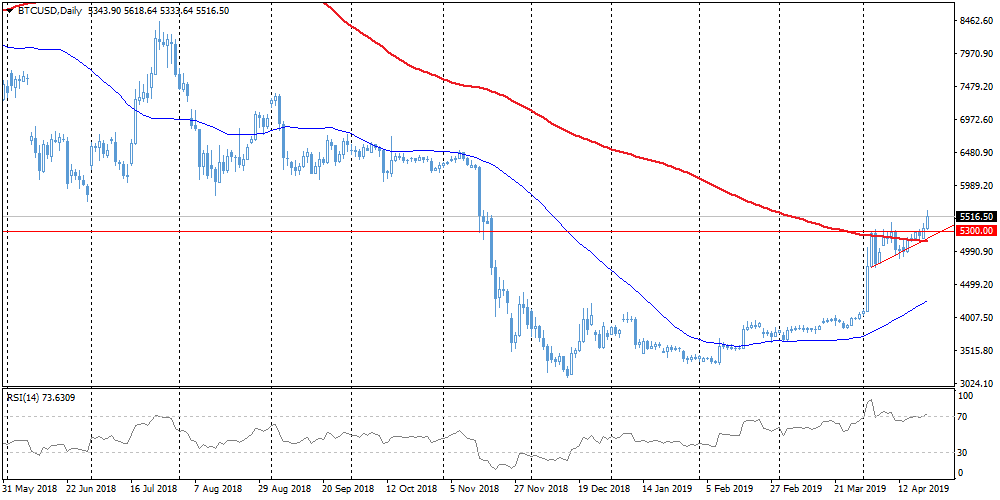

Bitcoin

Over the past day, Bitcoin has confirmed that the technical analysis works pretty well in the crypto market. The course of the benchmark cryptocurrency has jumped to $5600 on Tuesday morning (+ 6.7%) After a breakout of resistance on $5300. In the case of growth momentum, the goal for Bulls could be the area $6000-$6100. However, it is necessary to remember, that the price is influenced by many factors, therefore abrupt jumps quite can be replaced with no less unpredictable failures.

Trade Responsibly. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.37% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider. The Analysts' opinions are for informational purposes only and should not be considered as a recommendation or trading advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.